4246 Insights

Your source for the latest news and information.

When Cash Met Pixels: The Rise of Digital Wallet Integrations

Explore the digital revolution as cash meets pixels! Discover how wallet integrations are reshaping payments and transforming our economy.

Exploring the Future: How Digital Wallets Are Transforming Commerce

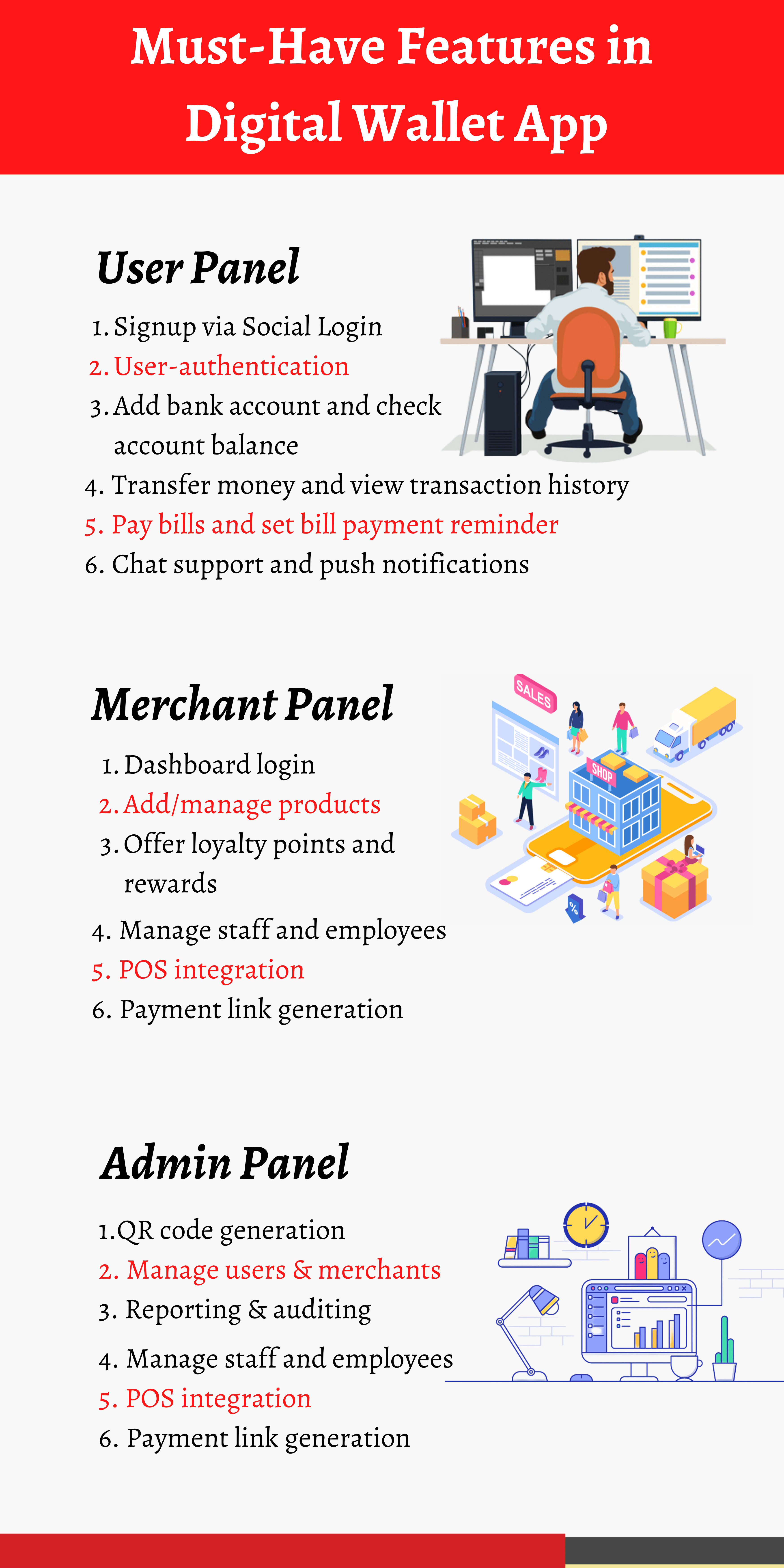

The rapid evolution of technology is reshaping how we conduct financial transactions, and digital wallets are at the forefront of this transformation. These innovative tools not only streamline payment processes but also enhance security through advanced encryption and authentication methods. As more consumers embrace digital wallets, businesses must adapt to this shift by integrating digital payment solutions. This adaptability not only improves the customer experience but also drives sales, making it essential for merchants to stay competitive in today's fast-paced market.

Looking ahead, the role of digital wallets in commerce is expected to grow significantly. According to industry analysts, we can anticipate several key trends:

- Increased Adoption: More consumers, especially younger generations, are choosing to shop virtually and prefer contactless payment options.

- Integration with Loyalty Programs: Businesses will leverage digital wallets to offer personalized rewards and incentives, enhancing customer loyalty.

- Expansion into New Markets: As mobile infrastructure improves globally, digital wallets will reach underbanked populations, revolutionizing commerce in emerging markets.

Counter-Strike is a highly popular first-person shooter game that pits teams of terrorists against counter-terrorists in various objective-based scenarios. Players can engage in tactical gameplay, utilizing strategies and teamwork to secure victory. If you're interested in enhancing your gaming experience, don't forget to check out our betpanda promo code for great deals!

The Benefits of Digital Wallet Integrations for Businesses and Consumers

The integration of digital wallets into business operations offers numerous advantages for both companies and consumers. For businesses, adopting digital wallets enhances payment processing speed, significantly reducing transaction times. This streamlined approach helps improve customer satisfaction, as consumers appreciate the convenience of quick and easy payments. Furthermore, digital wallet integrations facilitate better data management, allowing companies to gain insightful analytics about spending habits and customer preferences, leading to more informed business decisions.

For consumers, the benefits of digital wallet integrations are equally compelling. First and foremost, they provide a secure and efficient way to conduct transactions without the need for physical cash or cards. With features like biometric authentication and encryption, users enjoy enhanced security while shopping. Additionally, digital wallets often come with rewards programs, discounts, and promotions that can save consumers money in the long run. As more businesses adopt these technologies, the synergy between businesses and consumers will continue to grow, fostering a convenient and rewarding shopping experience for all.

What You Need to Know About Securing Your Digital Wallet Transactions

With the rise of digital wallets in today's fast-paced world, understanding how to secure your digital wallet transactions has never been more crucial. Digital wallets store sensitive information, including credit card details and personal data, making them prime targets for cybercriminals. To protect your transactions, always ensure that you use a strong, unique password combined with two-factor authentication (2FA). This adds an extra layer of security, making it significantly more difficult for unauthorized users to access your wallet.

In addition to using robust password protection, it's essential to recognize potential risks associated with public Wi-Fi networks. When making digital wallet transactions while connected to public Wi-Fi, consider using a virtual private network (VPN) to encrypt your internet connection. Moreover, regularly updating your wallet app and operating system will safeguard against vulnerabilities. By adhering to these practices, you can confidently manage your finances while minimizing the risks associated with digital transactions.