4246 Insights

Your source for the latest news and information.

Budgeting Like a Boss: Transform Your Finances Overnight

Master your money with our expert tips! Transform your finances overnight and budget like a boss. Start your financial journey today!

10 Simple Steps to Master Your Budget in 30 Days

Mastering your budget is an essential skill that can lead to financial freedom and peace of mind. In just 30 days, you can develop a solid financial plan by following these 10 simple steps. Start by setting clear financial goals, whether it’s saving for a vacation, paying off debt, or building an emergency fund. Understanding your financial objectives will give you a solid foundation for your budgeting journey.

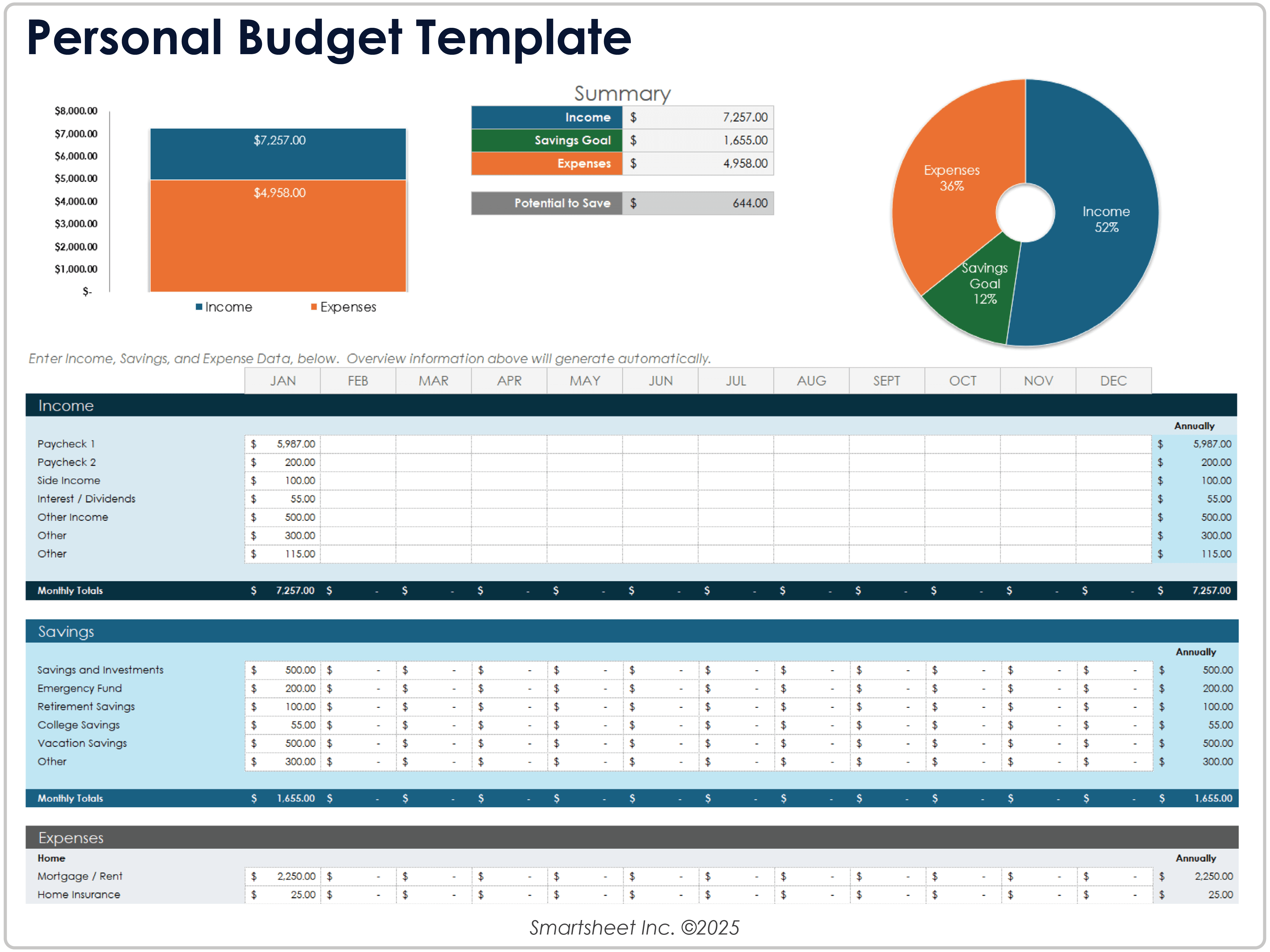

- Track Your Income and Expenses: Begin by documenting all sources of income and every expense for a month. This will help you see where your money goes.

- Set a Budget: Based on your tracked expenses, create a realistic budget that prioritizes your needs.

- Choose a Budgeting Method: Whether it’s the envelope system or a digital tool, find a budgeting method that works for you.

- Identify Unnecessary Expenses: Look for areas where you can cut back, like dining out or subscription services.

- Implement the 50/30/20 Rule: Allocate 50% for needs, 30% for wants, and 20% for savings and debt repayment.

- Monitor Your Progress: Regularly check your budget to see how well you’re sticking to it.

- Adjust as Needed: Be flexible and willing to change your budget as life circumstances change.

- Save for Emergency Expenses: Aim to build an emergency fund that covers 3-6 months of expenses.

- Review and Reflect: At the end of the month, review your budgeting process and reflect on what worked and what didn’t.

- Stay Consistent: Budgeting requires commitment. Stick to your plan, and you’ll be amazed at the results.

Counter-Strike is a highly popular first-person shooter game that has captivated players around the world. Known for its competitive gameplay and strategic elements, it pits two teams against each other—Terrorists and Counter-Terrorists—in various objectives. Players can enhance their gaming experience with various gaming gear, and for those looking for more than just a mouse and keyboard, check out these Top 10 iphone accessories under 100.

How to Create a Realistic Budget That Works for You

Creating a realistic budget is essential for managing your finances effectively. Start by gathering all your financial information, including income, expenses, and debts. Identifying your fixed and variable expenses is crucial; fixed expenses typically include rent and loan payments, while variable expenses can be more flexible, like groceries and entertainment. Once you have a clear picture of your financial situation, you can set specific, achievable goals for your spending and savings. This practice allows you to allocate funds toward essential expenses while still leaving room for personal enjoyment.

Next, it’s important to use budgeting tools that work for you. You can opt for traditional pen-and-paper methods or explore various budgeting apps available online. Consider implementing the 50/30/20 rule, which divides your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. Adjust this formula to fit your lifestyle and priorities, and make sure to review and adjust your budget regularly. By staying flexible and keeping a close eye on your spending, you’ll find it easier to stick to a budget that genuinely works for you.

Budgeting Myths Debunked: What You Really Need to Know

When it comes to budgeting, many myths can cloud your understanding and lead you to misguided financial decisions. One prevalent myth is that budgeting is only for those who are struggling financially. In reality, budgeting is a tool that everyone can benefit from, regardless of their financial situation. It helps in setting financial goals, tracking spending habits, and preparing for unexpected expenses. By dispelling this myth, you can take the first step towards gaining control over your finances.

Another common myth is that creating a budget is a time-consuming and complicated process. Many people believe that they need extensive financial knowledge to manage their money effectively. However, this is far from the truth! In fact, budgeting can be as simple as tracking your income and expenses using a basic spreadsheet or budgeting app. Start by listing your income sources and categorizing your expenses into fixed and variable costs. By breaking it down into manageable steps, you'll quickly discover that budgeting is more achievable than you thought.