4246 Insights

Your source for the latest news and information.

Discounts that Drive Savings: How to Slash Your Auto Insurance Bill

Discover hidden discounts to slash your auto insurance bill and boost your savings today! Don't miss out on big savings—click now!

Top 10 Discounts You Didn't Know You Could Get on Your Auto Insurance

When it comes to saving money on your auto insurance, many drivers are unaware of the numerous discounts that are available to them. Here are the top 10 discounts you might not know you could qualify for:

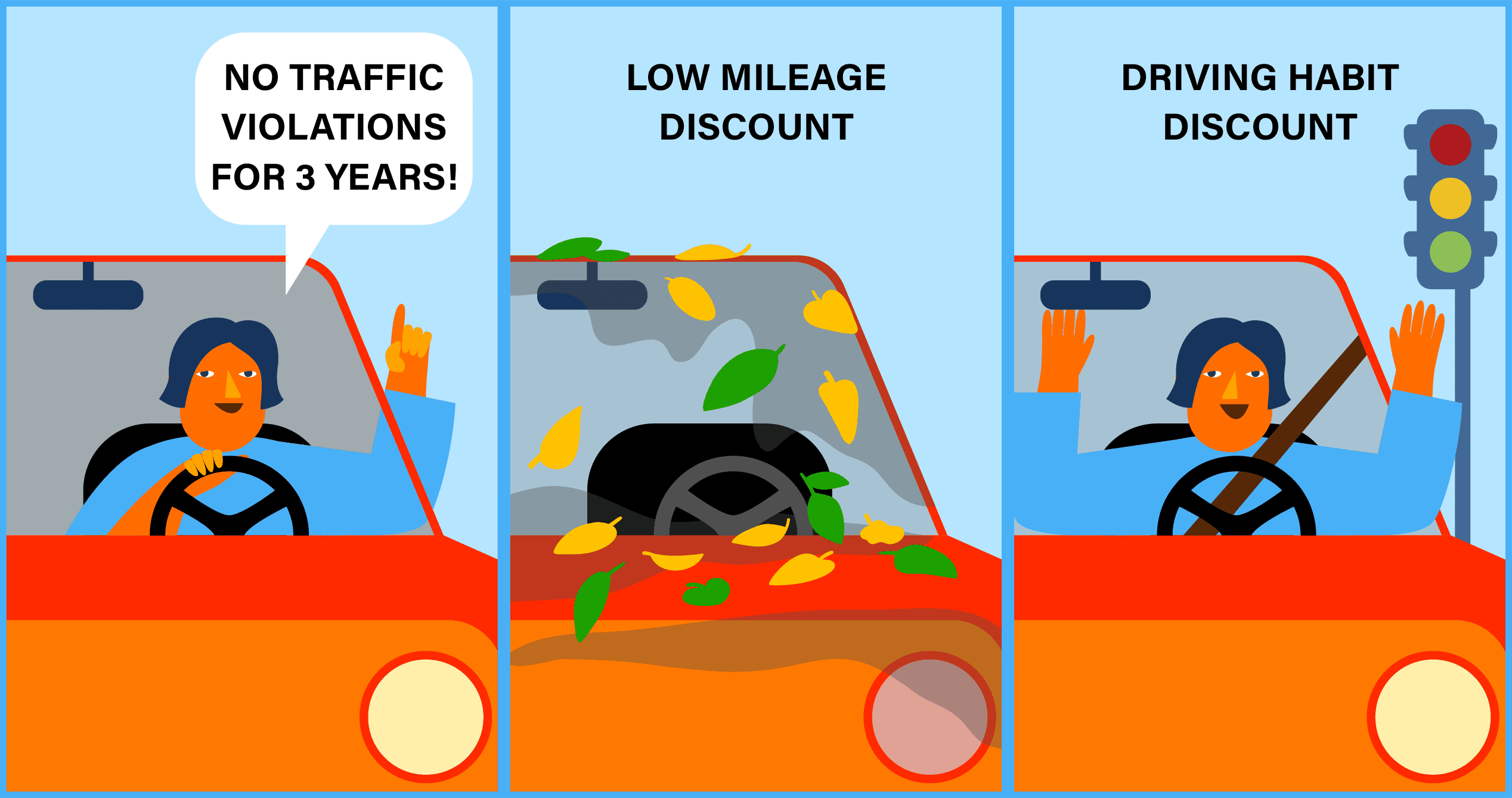

- Safe Driver Discount: If you have a clean driving record, you may be eligible for a discount for your responsible driving habits.

- Multi-Policy Discount: Bundling your auto insurance with other policies, such as home or renters insurance, can lead to significant savings.

- Low Mileage Discount: If you drive less than the average person, some insurers offer discounts for lower mileage.

- Good Student Discount: Young drivers who maintain a GPA above a certain threshold can receive discounts.

- Military Discount: Active or retired military personnel may qualify for special rates.

Additionally, there are numerous other discounts that can help you save even more:

- Defensive Driving Course Discount: Completing an approved defensive driving course can often reduce your premium.

- Senior Discount: Many insurance companies offer reduced rates for seniors.

- Vehicle Safety Features Discount: Cars equipped with advanced safety features may qualify for lower premiums.

- Pay-in-Full Discount: If you pay your annual premium upfront, you may receive a discount.

- Membership Discounts: Membership in certain organizations can lead to special insurance rates.

How to Compare Auto Insurance Quotes to Find the Best Discounts

When it comes to comparing auto insurance quotes, there are several key factors to consider that can help you find the best discounts available. Start by gathering quotes from multiple insurance providers, as this will allow you to see a range of options and pricing. Make sure to provide the same information to each company, including your driving history, vehicle details, and coverage requirements. By doing so, you ensure that the quotes are comparable and reflect the same level of coverage.

Next, evaluate each quote based on several criteria. Look for discounts that might apply to you, such as multi-policy discounts, good driver discounts, or discounts for safety features in your car. Create a simple comparison chart to track the different policies, their premiums, and any pertinent discounts. Prioritize what matters most to you—whether it’s the monthly premium, deductible, or specific coverage options. This methodical approach will help you determine which insurance provider offers the best value for your needs.

Is Bundling Your Auto and Home Insurance the Secret to Big Savings?

Is bundling your auto and home insurance the secret to big savings? Many homeowners and drivers often overlook the potential cost savings that can come from bundling insurance policies. When you choose to combine your auto and home insurance with the same provider, you may be eligible for significant discounts—sometimes as much as 25% off your premiums. This financial benefit is especially appealing for those looking to cut monthly expenses without sacrificing coverage. Additionally, bundling simplifies your insurance management, allowing you to easily coordinate payments and understand your coverage options.

Beyond mere savings, bundling your insurance can enhance your customer experience. Many insurers offer improved service and tailored coverage options for bundled policies, ensuring you have all your protection needs met in one place. It may also lead to more consistent communication regarding policy updates or claims. As you consider whether bundling is right for you, it's essential to compare quotes from different providers. This way, you can determine if the potential savings outweigh the benefits of keeping your policies separate, ultimately making an informed decision that can secure both your home and vehicle at a lower cost.