4246 Insights

Your source for the latest news and information.

Drive Smart, Save Big: Secrets to Scoring Auto Insurance Discounts

Unlock the secrets to massive auto insurance discounts! Drive smart and start saving big today with our expert tips and tricks.

10 Tips to Maximize Your Auto Insurance Discounts

Finding ways to maximize your auto insurance discounts can significantly reduce your overall premium costs. Begin by shopping around and comparing quotes from different insurance providers, as many companies offer various discounts based on factors like your driving record, vehicle safety features, and even your occupation. It's also wise to inquire about bundling policies—many insurers provide substantial savings when you combine auto insurance with home or renters insurance.

Additionally, consider taking advantage of defensive driving courses, which can lead to discounts upon completion. Maintaining a good credit score and a clean driving record are also crucial, as they can open doors to lower rates. Don’t forget to ask about discounts for low mileage or being a member of specific organizations. Lastly, remember to review your policy regularly and adjust it as necessary, so you can continuously benefit from potential auto insurance discounts.

How Safe Driving Habits Can Lower Your Premiums

Adopting safe driving habits is not only crucial for your safety on the road but also plays a significant role in lowering your insurance premiums. Insurance companies often review your driving history as part of their underwriting process, and a clean record can result in substantial savings. Simple actions such as obeying traffic signals, avoiding distractions, and maintaining a consistent speed can contribute to fewer accidents and claims, which in turn signals to insurers that you are a lower risk driver.

Moreover, many insurers offer discounts for drivers who participate in safe driving programs or complete defensive driving courses. These programs often teach advanced skills and techniques on how to drive more cautiously and responsibly. By demonstrating your commitment to safe driving practices, you can qualify for additional savings. It's essential to stay informed about various discounts available and take proactive steps towards better driving habits, as these can significantly impact your overall insurance costs.

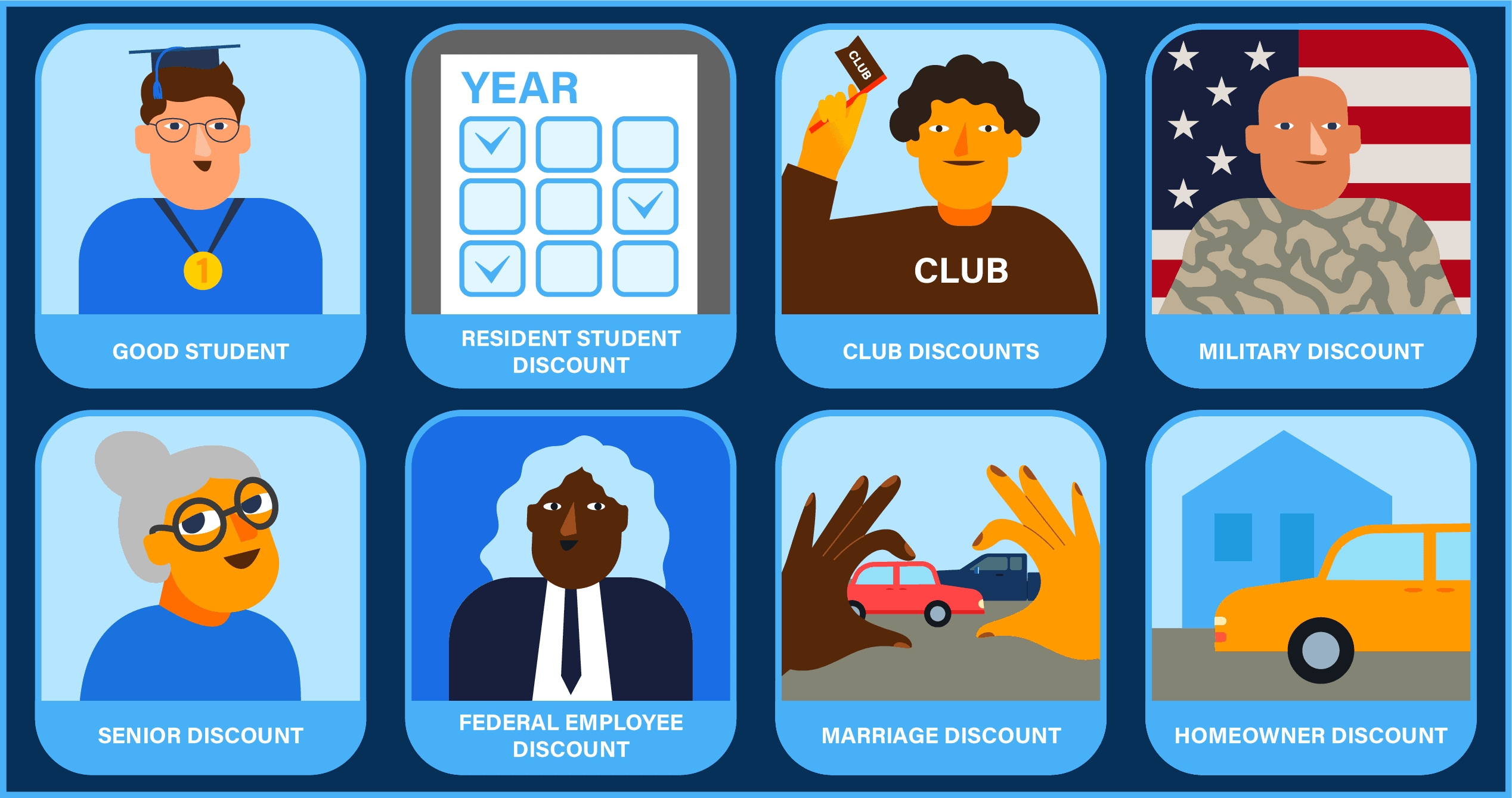

Are You Missing Out on These Common Auto Insurance Discounts?

Many drivers are unaware of the common auto insurance discounts available to them, which can significantly reduce their premiums. For instance, insurers often provide discounts for policyholders who maintain a clean driving record, showcasing their commitment to safety. Additionally, bundling multiple insurance policies, such as home and auto, can lead to substantial savings. Consider inquiring about discounts for low mileage or being a member of certain organizations—these can provide even more opportunities to save.

Another often-overlooked discount is the good student discount, which is available to drivers under a certain age who excel academically. Insurance companies recognize that students with higher grades tend to be more responsible on the road. Furthermore, enrollment in defensive driving courses can also qualify drivers for discounts. It's essential to review your policy and speak with your insurance provider to ensure you're not missing out on these valuable savings. Don't leave money on the table!